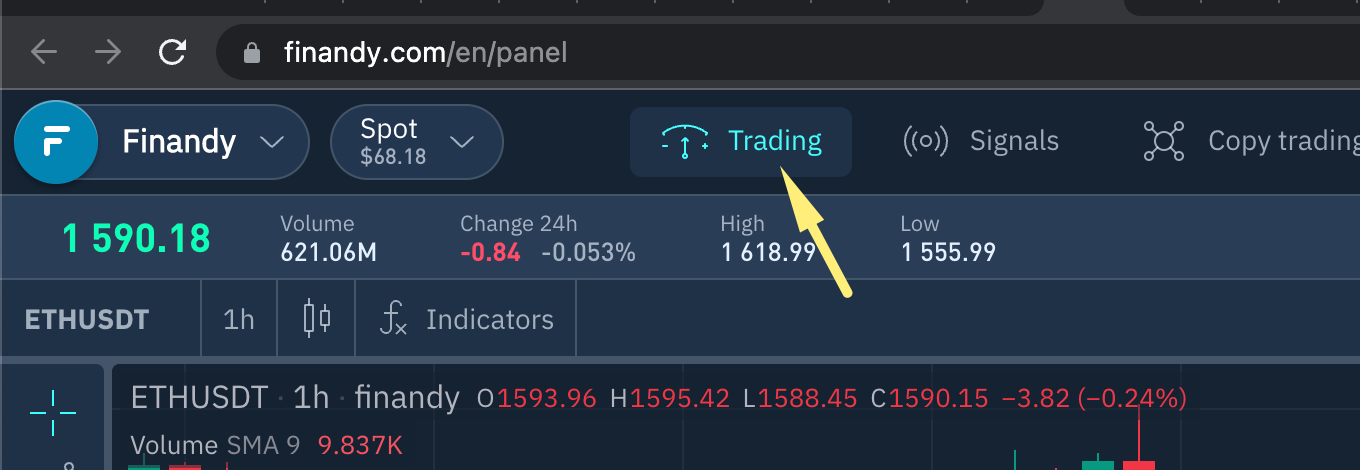

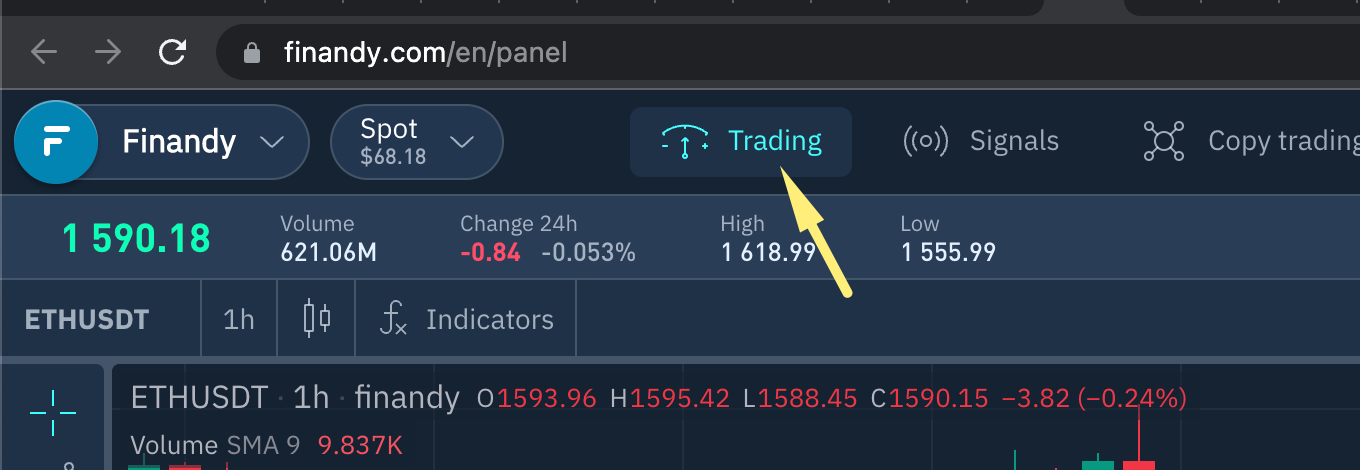

Create order/grid

✔ Detailed description on creating orders and order grids, setting stop-losses, trailing and take-profits.

Last updated

✔ Detailed description on creating orders and order grids, setting stop-losses, trailing and take-profits.

Last updated