Stop Loss (SL)

✔ Learn how to set and use stop losses on the Finandy platform: setting levels, order types and calculation methods. Detailed guide to working with stop losses.

Real Take Profit and Stop Loss orders cannot be set simultaneously in the SPOT market, If attempted, the system replaces the Stop order with a virtual one.

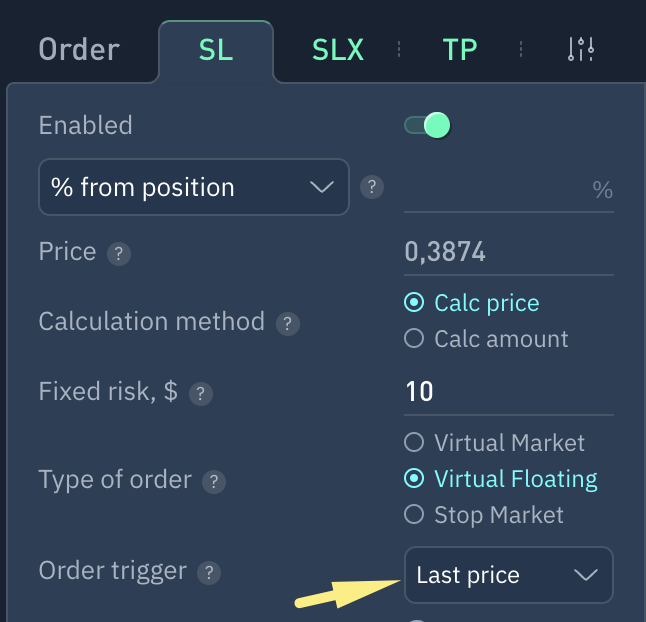

Enabling SL module, will place a Stop Loss based on its settings when opening a position.

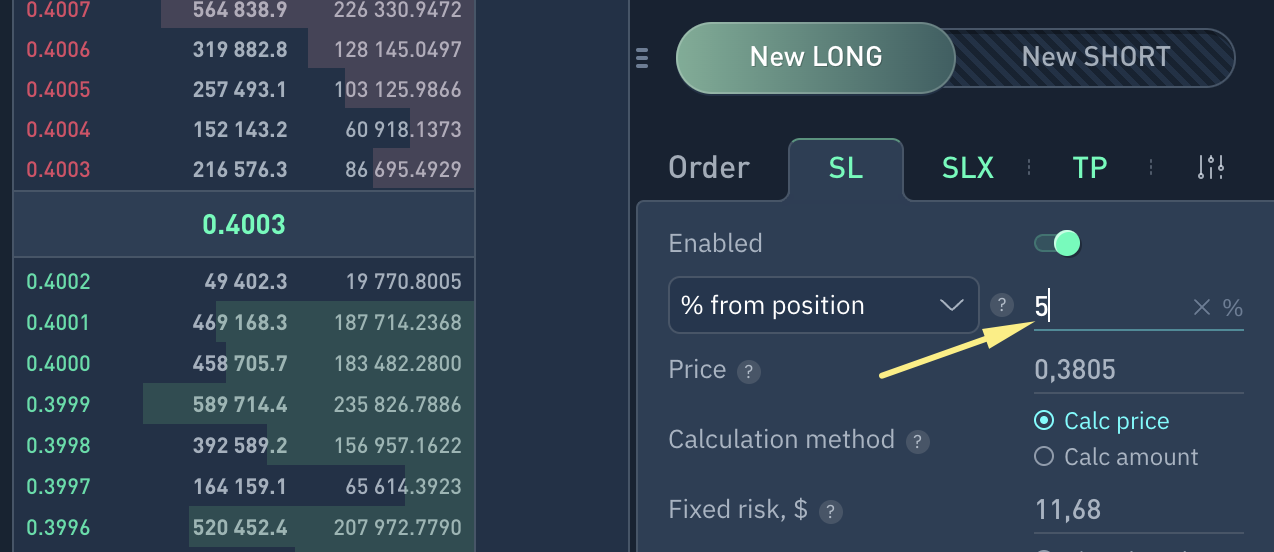

1. SL level, %

Stop loss will be placed with a % offset:

from position's break-even level. When SL level reordering (#7) is disabled, the stop loss will be based on the price of the first executed order within the position.

from DCA order´s average price.

For example, If the first executed order in a Long position was at 0.4 (including commissions), and a Stop Loss is set at 5% from position price, then the Stop Loss order will be placed at 0.38.

2. Specific Stop Loss price

Absolute Stop Loss value can be set using the keyboard numbers or arrows.

Dragging the order on chart with your mouse is also possible.

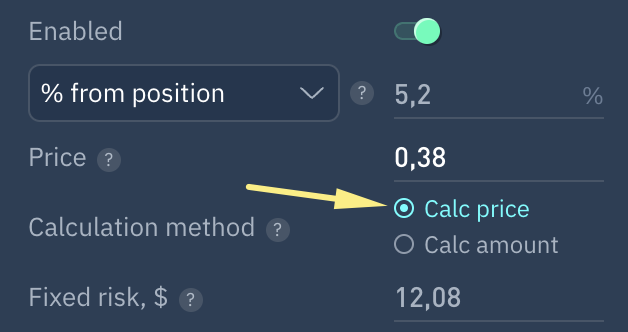

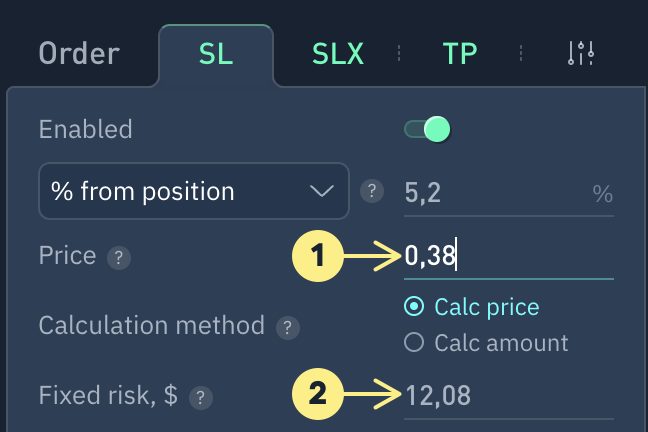

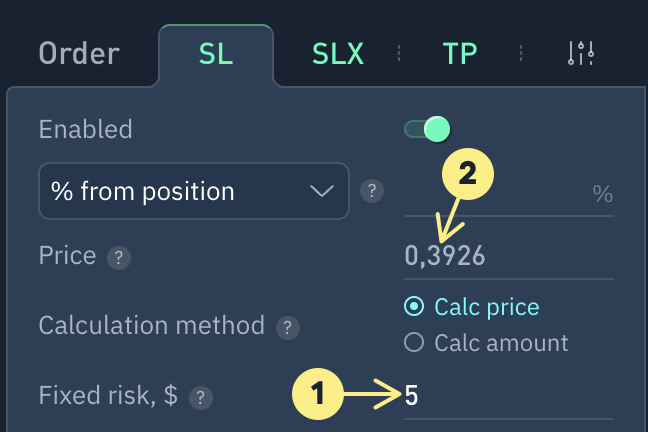

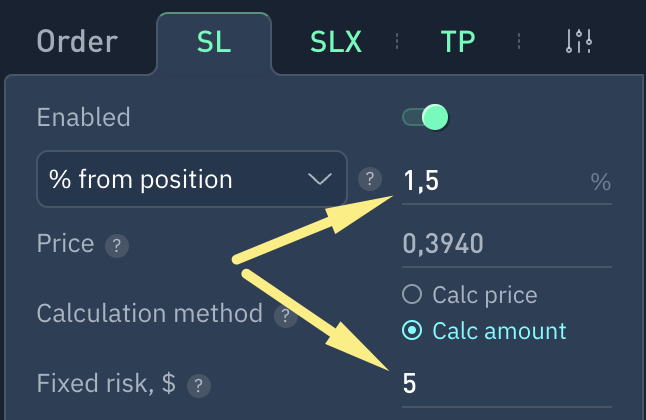

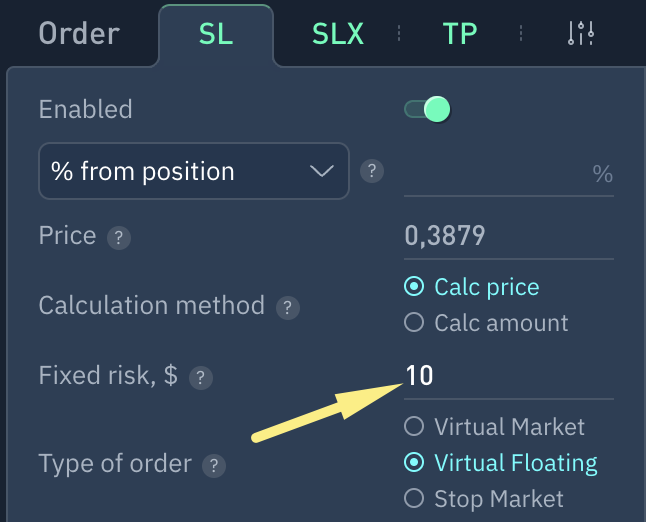

3. Calculation method

Fixed price

At a given Stop Loss price (1), loss Amount (2) is calculated:

or vice versa, for a given loss amount (1) the stop loss price (2) is calculated:

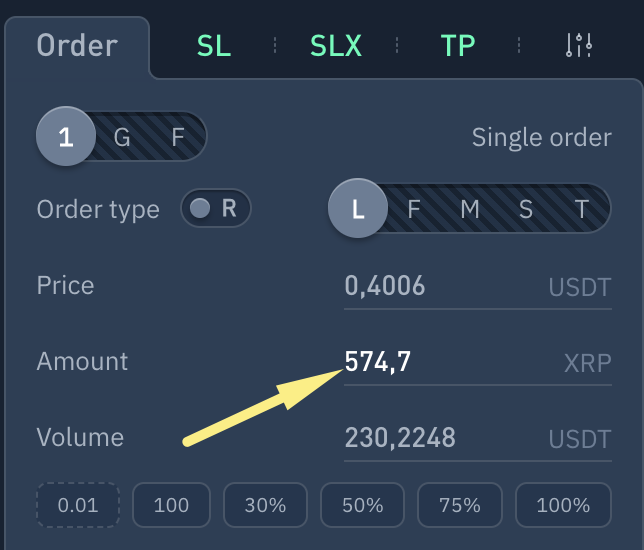

Amount calculation

Number of orders for position opening will be calculated

set a Stop Loss based on a specified risk amount and price (% offset).

Note: Automatic grid level updates do not recalculate token amount in orders.

4. Risk amount

Estimated loss in dollars when closing position at Stop Loss level.

SL level is automatically filled in when % offset for Stop Loss is entered.

By filling in this field, SL level is calculated to ensure that the specified risk equals the loss at Stop Loss.

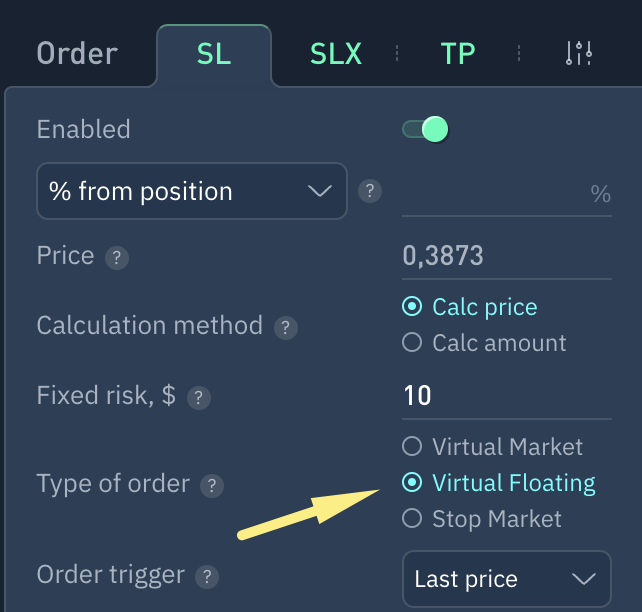

5. Order Type

Virtual Floating - limit order with auto-swaps. It is more profitable to exit in currencies with a wider spread.

Virtual Market - a virtual order that triggers a real order to execute bids from other market participants at market price.

Stop Market - is a type of exchange order that initiates a market order once the stop price is triggered*.

*Be aware of market liquidity and volatility when using market orders, as they can execute at a price that is higher/lower than the most recent visible.

6. Order trigger

Additional options for virtual orders.

Trigger for virtual stop loss to close position with a real order.

Current price If virtual order's trigger price crosses the currency pair price, a real order is created (step 5).

Order book Checks the sell limit price for a Long position and the buy limit price for a Short position. Protects against false price movements (squeezes).

1m candle, 3m candle etc. First value is candle's timeframe. Long position will be closed by Stop Loss if the trigger candle closes at or below the SL level. Short position will be closed by Stop Loss if the trigger candle closes at or above the SL level.

7. Level Reordering

If enabled, SL adjusts automatically after averaging position price, maintaining the same offset from position´s price as before.

Do you have any questions? We can help you in our Telegram chat.

Last updated