Open position

✔ Learn how to buy or sell with TradingView signal on Binance, OKX, Finandy: order parameters, order types, option management and restrictions. Instructions on how to open a position.

Order/Grid opening settings

1. Enabled / Disabled

Enabling this option creates a position based on the received signal. If a position is already open, the 'Averaging' and 'Closing' settings are used.

Attention! Open positions are restricted to a maximum of 80 currency pairs.

In one-way mode, you can hold a maximum of 80 open positions.

In hedge-mode, you can hold up to 160 open positions on 80 currency pairs.

2. Single Order / Grid Order

Learn more about Grid parameters:

3. Real / virtual order

R - real orders. Order sent to the exchange.

V - virtual orders. Order is created in terminal and only sent to the exchange when activation conditions are met.

Virtual order4. Order Amount / Volume

Amount Specify the token quantity (contracts) for the created order in the right-hand field. For example, if you enter 100 for XRPUSDT, an order for 100 XRP will be placed.

Volume Order quantity (volume) is specified. For example, entering 0.01 for LTCBTC pair will place an order with a volume of 0.01 BTC.

Volume, USD Order quantity (volume) is specified in dollars. For example, if 100 is specified for the LTCBTC pair, an order with a volume equivalent to $100 will be created.

Full Balance, % Orders are created based on a percentage of the total balance.(wallet balance + position volume + position PnL). For example, with 1000 USDT in the wallet, 2000 USDT in positions, a PnL of 100 USDT and a specified 10% balance, the order will be created for (1000 + 2000 + 100) x 10 / 100 = 310 USDT.

The full balance includes all tokens in your account. For instance, if your wallet holds 100 BUSD and 100 USDT, the total balance would be 200.

Full Balance% х Leverage Just like in the previous example, but the obtained amount is multiplied by the leverage. From the example above, with a leverage of 5x the order amount would be 1550 USDT.

Free Balance, % Orders are created based on a percentage of the available balance in the specified market. For example, with 500 USDT in your wallet, 100 USDT in positions, and a 10% balance specification, the order will be created for an amount of (500 - 100) x 10 / 100 = 40 USDT.

Free Balance % х Leverage Just like in the previous example, but the obtained amount is multiplied by the leverage. For example, using the data from the previous item and a 7x everage, the order amount will be 40*7=280 USDT.

Strategy amount When this option is selected, the signal message will contain the placeholder {{strategy.order.contracts}}, and a checkbox on the left will be checked.

5. Order type

Order types6. Controlling options in the signal

To manage settings from signals, check the left box and save your changes.

In this example, the order volume is determined by the signal message.

To change the Order Volume to 500, manually edit the value from 100 to 500 in the signal message and Save.

Unchecking the left box next to option name in the Terminal and clicking "Save" applies the setting from the Terminal, even if the signal message code contains the option.

✅ If checked - option is applied from the received Signal message.

◻ If unchecked - option is applied from the Terminal settings.

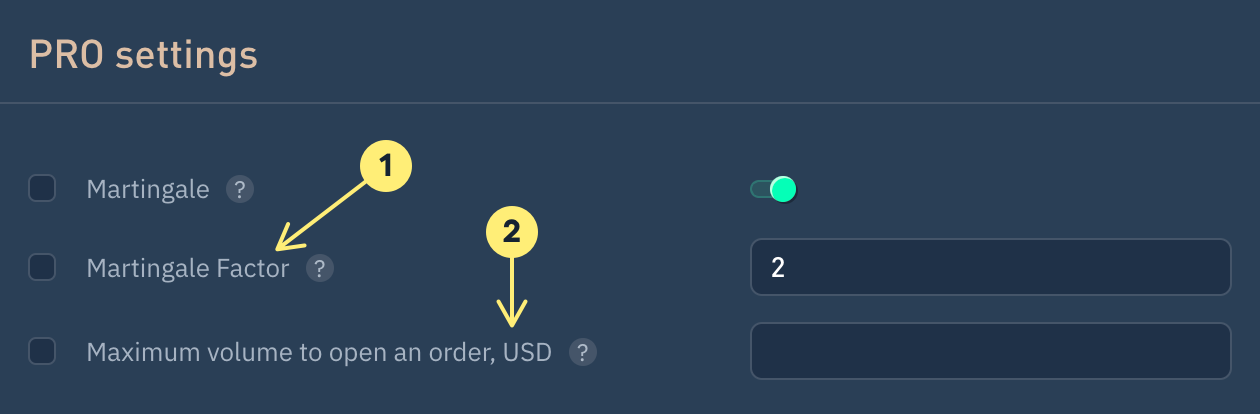

Pro settings

Martingale

If Martingale is activated,the new position's volume is the previous position multiplied by the specified Multiplier in case of a loss for this currency pair. If the previous position was profitable, the new position will be opened according to the opening settings.

Martingale Factor

If the previous position closed with a loss, the volume of the order opening the position will be multiplied by the specified Multiplier.

Maximum volume to open an order, USD

If the volume of the opening order for a new position exceeds the specified value in USD, the position will not be created, and the webhook will be TURNED OFF. Once you re-enable the webhook, the Martingale will start again from the beginning, and the order will be created according to the opening settings.

Example

Position opening volume = 40 USDT

Max opening order volume: 100 USD

Multiplier = 2

Trading takes place on 1 currency pair, as the Martingale operates by default with 1 currency pair.

The first position is opened with 40 USDT as the opening settings. The position closed at a loss.

Received a signal to open a position. Since the previous position was in a loss, the volume calculation is now activated using the Martingale formula: The volume of the previous position x Multiplier = 40 x 2 = 80. Next, the order volume is compared with the 'Maximum opening order volume' parameter. The system approves the order placement since the volume is within the allowed limit. The position closed with a profit.

Received a signal to open a position. Since the previous position was profitable, the position is opened with 40 USDT. The Martingale is not activated, and the order volume remains the same. The position closed with a loss.

Received a signal to open a position. Since the previous position incurred a loss, the volume calculation is enabled using the Martingale: 40 x 2 = 80. Next, the order volume is compared to the parameter 'Maximum opening order volume.' The system approves the placement of the order since the opening order volume is less than the maximum.

Received a signal to open a position. Since the previous position was in a loss, the volume calculation based on Martingale is activated: 80 x 2 = 160. Next, the order volume is compared with the parameter 'Maximum opening order volume.' The system prevents the order placement as the volume of the opening order is GREATER than the Maximum. The connected signal (webhook) has been TURNED OFF. Subsequent signals will be ignored from this point forward.

To continue trading, you need to manually ENABLE the webhook. All incoming signals will follow the same scenario as described above, starting from step 1.

Futures position settings

Crossed / isolated margin ◻ If disabled ("Cross"), the entire wallet balance serves as collateral. ✅ If enabled ("Isolated"), an isolated margin is allocated for each position, and in the event of liquidation, only the allocated amount for that position is lost.

Leverage Higher leverage increases the risk of liquidation. Impacting collateral formation (margin).

Limits

1. Position side

Both When a buy signal is received, a LONG position will be opened, and when a sell signal is received, a SHORT position will be opened. This is used for reversals.

Strategy The position opens based on your strategy's direction.

Long only Only LONG positions will be opened. Signals opening SHORT positions will be ignored.

Short only Only SHORT positions will be opened. Signals to open LONG positions will be ignored.

In hedge mode, select "Strategy" for strategies and "Long Only" or "Short Only" for indicators.

Logic for processing the received signal to BUY with position side BOTH

Position opening

Action

No opened position

Opening Long position

Long

Averaging Long positions if allowed in signal settings

Short

Close Short position if allowed in signal settings

Logic for processing the received signal to SELL with position side BOTH

Position opening

Action

No opened position

Opening Short position

Long

Close Long position if allowed in signal settings

Short

Averaging Short positions if allowed in signal settings

2. Order Auto-cancellation

After a specified time, the order will be canceled automatically.

3. Timeout

Time interval in minutes between position creation.

The system ignores the signal if the time between closing the last position and the current signal is less than the specified timeout.

4. Maximum open positions

The position will not be opened if the total number of open positions exceeds the specified value.

Leave blank to remove the limit.

5. Max total position Volume, USD

The position will not be opened if total USD value of all open positions + opening order specified in the signal, exceeds the specified limit.

Leave blank to remove the limit.

6. Max open positions per hook

If the number of open positions created by this hook exceeds the specified value, the position will not be opened.

Leave blank to remove the limit.

7. Max open positions Volume per hook, USD

The position will not be opened if the total amount in USD of positions created by this hook + opening order, exceeds the specified value.

Leave blank to remove the limit.

8. Currency Pair Blacklist

Excluded currency pairs for position opening.

Separate pair names with commas or paste as a list and click the green "plus" sign.

9. Currency Pair Whitelist

Permitted currency pairs for position opening.

Separate pair names with commas or paste as a list and click the green "plus" sign.

If the list is empty, positions can be created on any pair except those in the currency pair blacklist.

If a currency pair is listed in both the blacklist and the whitelist, signals for that pair will be ignored.

Do you have any questions? We can help you in our Telegram chat room.

Last updated