Trailing (SLX)

✔ Learn how to set stop loss trailing on TradingView signal on Binance, OKX, Finandy exchange: traditional price trailing, take profit trailing, settings and actions.

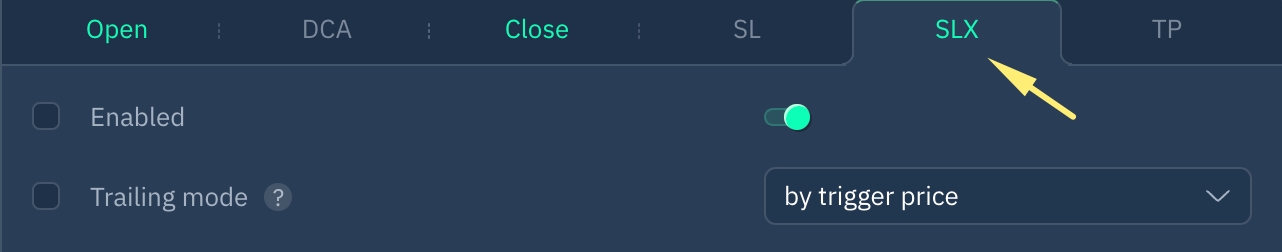

Finandy service offers 2 trailing types:

Trailing Stop Loss at trigger price (traditional trailing)

Trailing Stop Loss at Take Profit

Changing the stop-loss price manually while the SLX module is active will disable the SLX module.

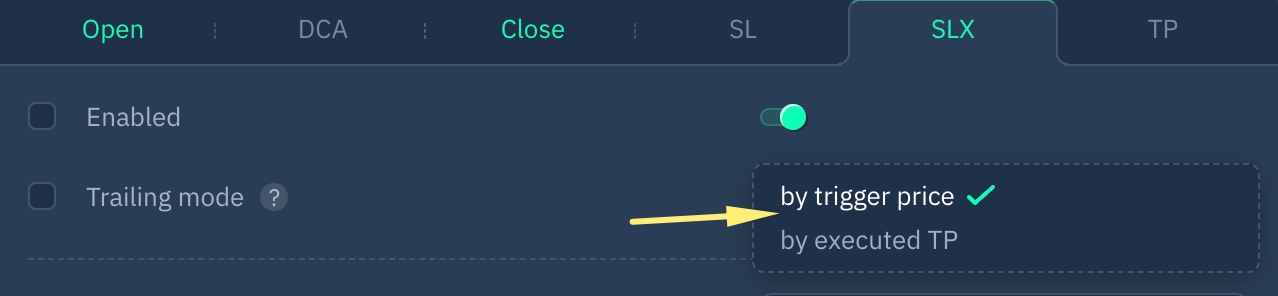

Currency price-based trailing

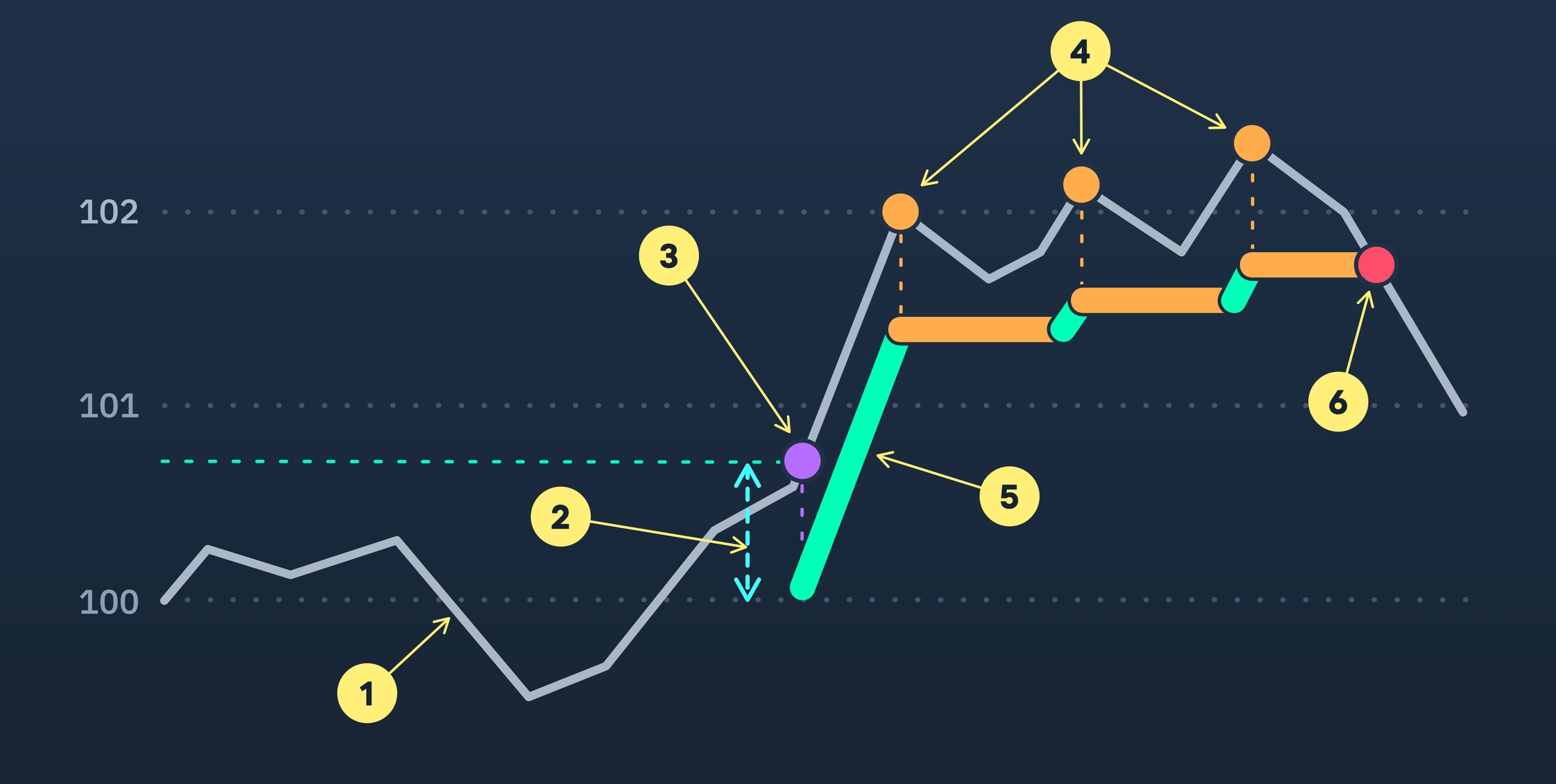

Trailing stop loss principles:

Currency pair price movement

Trailing stop repositioning

Trailing Trigger Points

Dynamic stop points

Stop loss activation

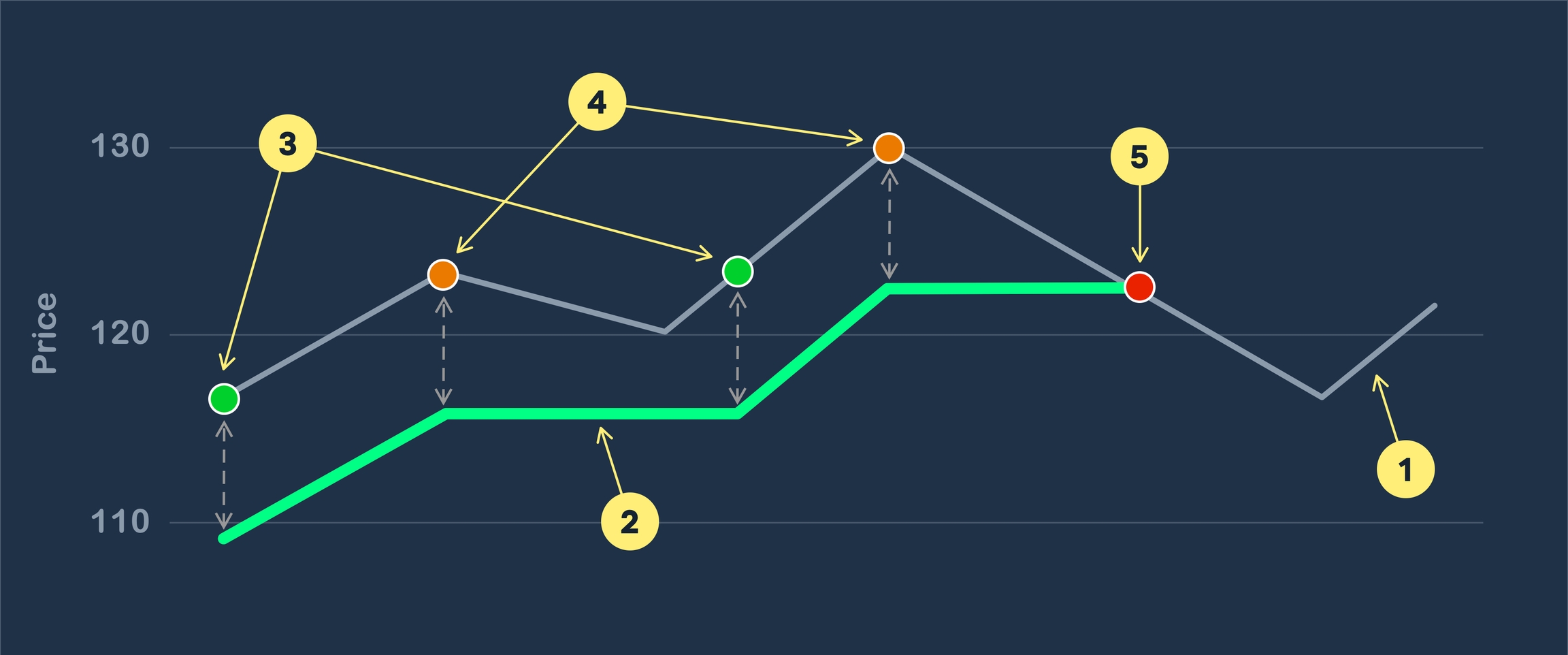

Settings:

1. Place at Breakeven, %

Stop Loss is automatically set to breakeven price when specified profit percentage is reached.

Disabled if field is blank.

2. Breakeven offset, %

The Stop Loss order is placed at a certain offset percentage from the breakeven price upon trigger activation in step 1. This feature can increase potential profit when the position is closed by Stop Loss.

If this field is blank, SLX will place an SL order at break-even price when the trigger in step 1 is activated.

3. Trailing activation (tracking)

Specify profit percentage for Trailing Stop activation. Disables SL module if active.

Disabled if field is blank.

4. Price offset trigger (callback rate)

Percentage gap between SL price and current currency pair price.

Currency pair price movements

VARIATION

Trailing stop activation

Dynamic stop points

Price movement controlled by SLX module for Stop orders

Position closing

Stop Loss follows the trend for Long positions when moving up and remains fixed when moving down.

For Short positions, the Stop Loss follows the trend when moving down and remains fixed when moving up.

5. Minimum repositioning step

Minimum percentage difference between current and new price required for Stop Loss movement when trigger is activated.

Currency pair price movement

Previous Stop Loss price

New Stop Loss price

Stop Loss relocation event

Minimum relocation step - distance equal to or greater than the minimum Stop Loss step

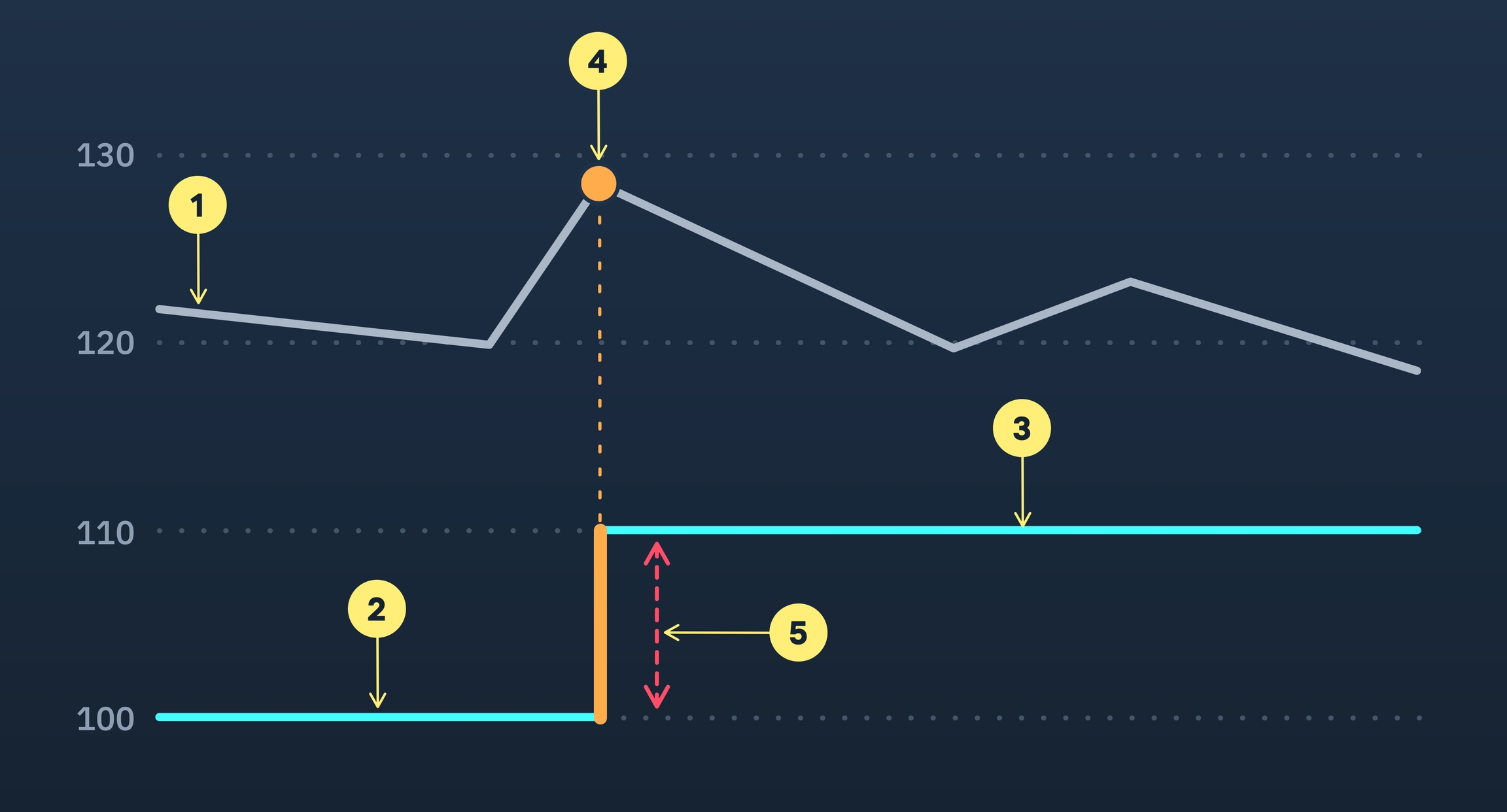

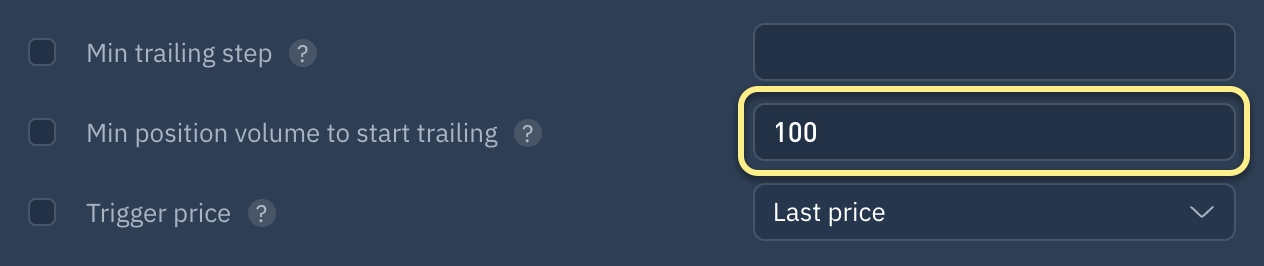

6. Min. position volume

If position volume is below the specified value, Trailing will not be activated and SL will not be adjusted to Breakeven.

Example

In this example, SLX module will set the stop loss to breakeven or start trailing only if the position size is overs 100.

1. Market buy for 50 USDT volume.

PnL

Position volume

Trailing

0%

50 USDT

-

2. Currency pair price increased, and trailing failed to start as position size was lower than the specified value.

PnL

Position volume

Trailing

1%

50 USDT

-

3. Position averaged out, but trailing stop still inactive as profit has not reached the set trigger.

PnL

Position volume

Trailing

0.4%

200 USDT

-

4. Currency pair price has increased and trailing has been activated.

PnL

Position volume

Trailing

0.7%

200 USDT

✅

7. Trigger price

Current price - follows currency pair current price.

Order book - follows best bid/ask price in the order book. Protects against false price movements (squeezes).

Candle Timeframe - SL is moved if candle's closing price deviates a certain percentage from the specified timeframe.

8. Order type

Order types9. Action on #CA

When placing a SL at breakeven level, averaging orders will be canceled or remain unchanged.

Parameter

Description

Disabled(default)

Averaging orders will remain active and NOT be canceled when the SLX module is enabled.

Cancel #CA

All averaging orders will be cancelled when the SLX module is enabled.

10. Update settings by signal

Update settings by signal11. Controlling an option in the signal

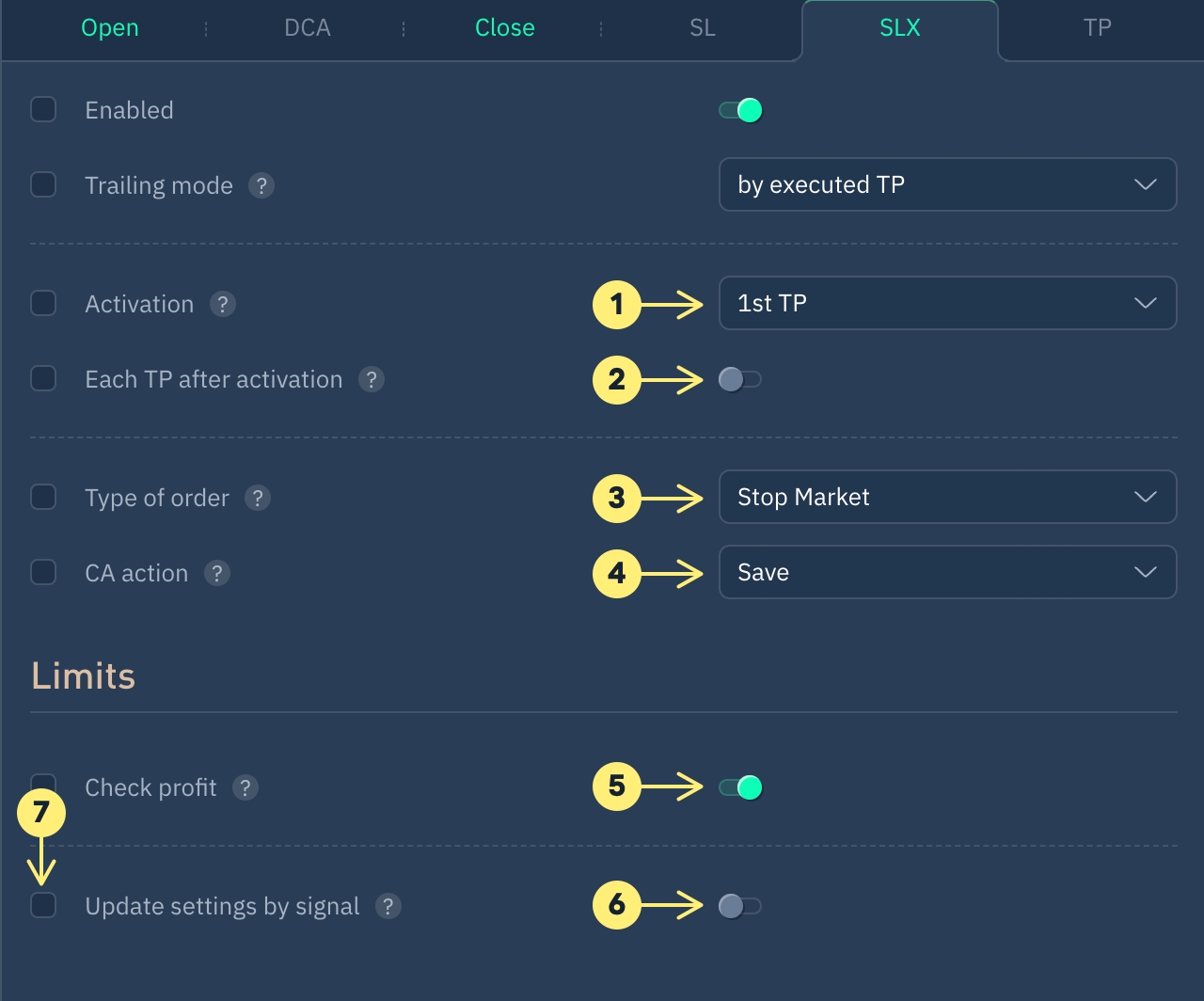

Controlling an option in the signalTrailing based on executed Take Profits

The module creates or repositions a Stop Loss when a Take Profit order is executed on a position.

1. Activation at BreakEven

When № Take Profit is executed, it moves to Break-even Point and continues to follow the executed Take Profit (if specified in set point #2).

For example, If you activate Break-Even (BE) at 1 TP execution, the module will cancel current Stop Loss (SL) after the first TP is executed and set a new SL at the original break-even price.

2. Each TP

Once activated, each executed Take Profit will move Stop Loss closer to the trend based on table´s algorithm. If deactivated, Stop Loss will be set at break-even position´s price and will not be adjusted.

Assuming activation occurs from the second TP, the module will perform the same actions for any other TP that triggers it.

Event

Action

Executed ТP #2

SLX module cancels all existing SLs and sets a new SL at break-even price with the specified order type.

Executed ТP #3

Cancels current SL, and set new SL at executed TP #1 price.

Executed ТP #4

Cancels current SL, and set new SL at executed TP #2 price.

etc

...and so on.

3. Order type

Order types4. Action on #CA

When placing a SL at breakeven level, averaging orders will be canceled or remain unchanged.

Parameter

Description

Disabled(default)

Averaging orders will remain active and NOT be canceled when the SLX module is enabled.

Cancel #CA

All averaging orders will be cancelled when the SLX module is enabled.

5. Check profit?

If enabled, SLX module will move the SL order only when there are profits in the position. If disabled, SLX module will move SL orders regardless of profit or loss.

6. Updating settings by signal

Update settings by signal7. Controlling an option in the signal

Controlling an option in the signalAdditionally

SLX activation is performed relative to the breakeven level for the position, but without funding. In case of negative funding for a position, closing a position through the SLX module may result in a loss. In the case of a long stay in a position, the influence of deduction/accrual for funding on the middle line is controlled by the trader independently.

Do you have any questions? We can help you in our Telegram chat room.

Last updated