Averaging (DCA)

✔ Instructions on how to increase a position. Learn how to buy (add to position) on TradingView signal on Binance, OKX, Finandy: order parameters, order types, option management and restrictions.

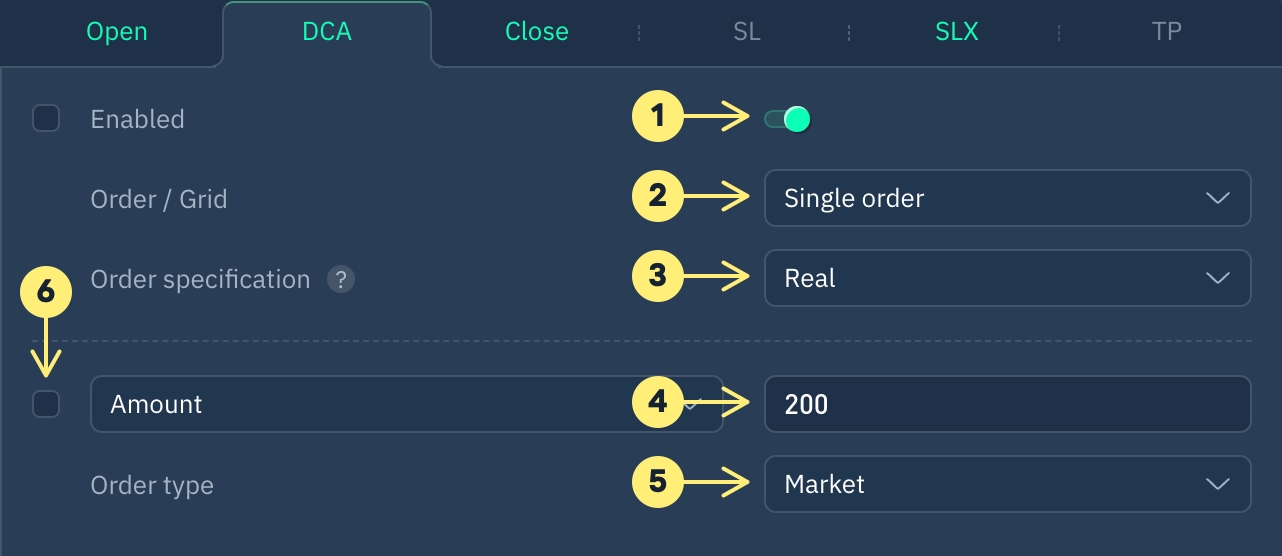

Averaging order settings

In a LONG positions, averaging is activated by a buy ↑ signal., for example:

In a SHORT positions, averaging is activated by a sell↓ signal, for example:

1. Enabled/ Disabled

If enabled, averaging order or order grid will be created upon signal reception.

2. Single order / grid order

Learn more about grid parameters:

3. Real / virtual order

A real order is placed on the exchange.

A virtual order is created in terminal and only sent to the exchange when activation conditions are met.

4. Order Amount / Volume

Amount Specify the token quantity (contracts) for the created order in the right-hand field.

For example, if you enter 100 for XRPUSDT, an order for 100 XRP will be placed.

Volume Order quantity (volume) is specified. For example, entering 0.01 for LTCBTC pair will place an order with a volume of 0.01 BTC.

Volume, USD Order quantity (volume) is specified in dollars. For example, if 100 is specified for the LTCBTC pair, an order with a volume equivalent to $100 will be created.

Full Balance, % Orders are created based on a percentage of the total balance.(wallet balance + position volume + position PnL). For example, with 1000 USDT in the wallet, 2000 USDT in positions, a PnL of 100 USDT, and a specified 10% balance, the order will be created for (1000 + 2000 + 100) x 10 / 100 = 310 USDT.

Full Balance% х Leverage Just like in the previous example, but the obtained amount is multiplied by the leverage. From the example above, with a leverage of 5x the order amount would be 1550 USDT.

Free Balance, % Orders are created based on a percentage of the available balance in the specified market. For example, with 500 USDT in your wallet, 100 USDT in positions, and a 10% balance specification, the order will be created for an amount of (500 - 100) x 10 / 100 = 40 USDT.

Free Balance х Leverage, % Just like in the previous example, but the obtained amount is multiplied by the leverage. For example, using the data from the previous item and a 7x leverage, the order amount will be 40*7=280 USDT.

Strategy amount When this option is selected, the signal message will contain the placeholder {{strategy.order.contracts}}, and a checkbox on the left will be checked.

Position volume, % Averaging quantity (volume) is based on a percentage of the current position. If you specify 100, it will average the same amount currently open.

Position amount, % Averaging token quantity (contracts) is based on a percentage of the current position. For instance, specifying 100 will average the same number of coins currently open.

5. Order type

Order types6. Controlling options in the signal

Controlling an option in the signalLimits

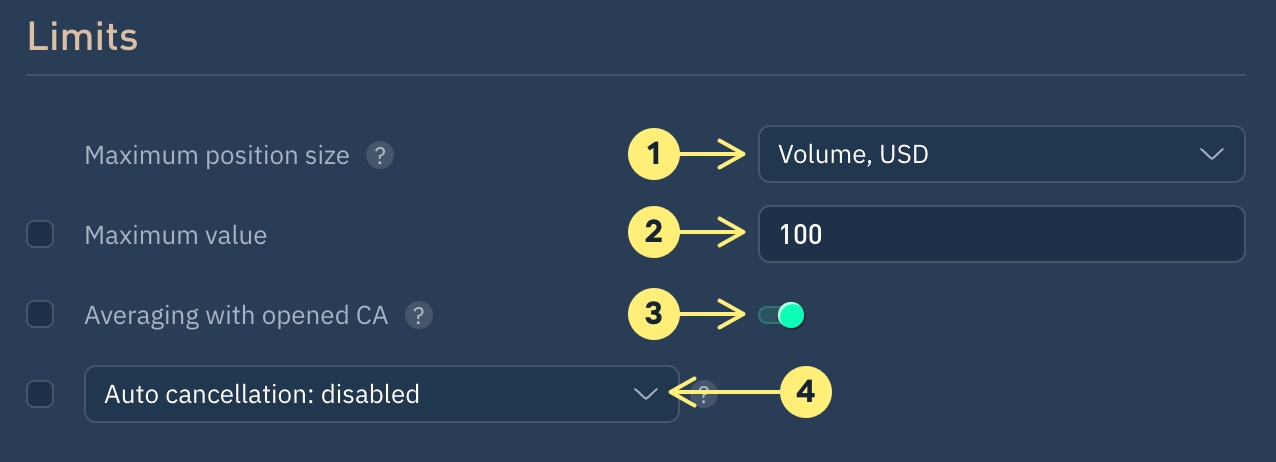

1. Maximum position size

Averaging is skipped if signal's averaging amount + position's amount exceeds the specified value.

2. Maximum value

Activate the additional field to set a maximum position size from point 1.

Leave blank to remove the limit.

3. Averaging with open AC orders

Disabling this option prevents averaging when there are unexecuted averaging orders in the position.

4. Order Auto-cancellation

After a specified time, the order will be canceled automatically.

Do you have any questions? We can help you in our Telegram chat room.

Last updated