Trailing Stop (SLX)

✔ Description of how to use Trailing Stop on the Finandy platform to automatically reposition stop loss at trigger price or executed take profit. Detailed guide on how to set up and operate

Finandy service offers 2 trailing types:

Trailing Stop Loss at trigger price (traditional trailing)

Trailing Stop Loss at Take Profit

Changing the stop-loss price manually while the SLX module is active will disable the SLX module.

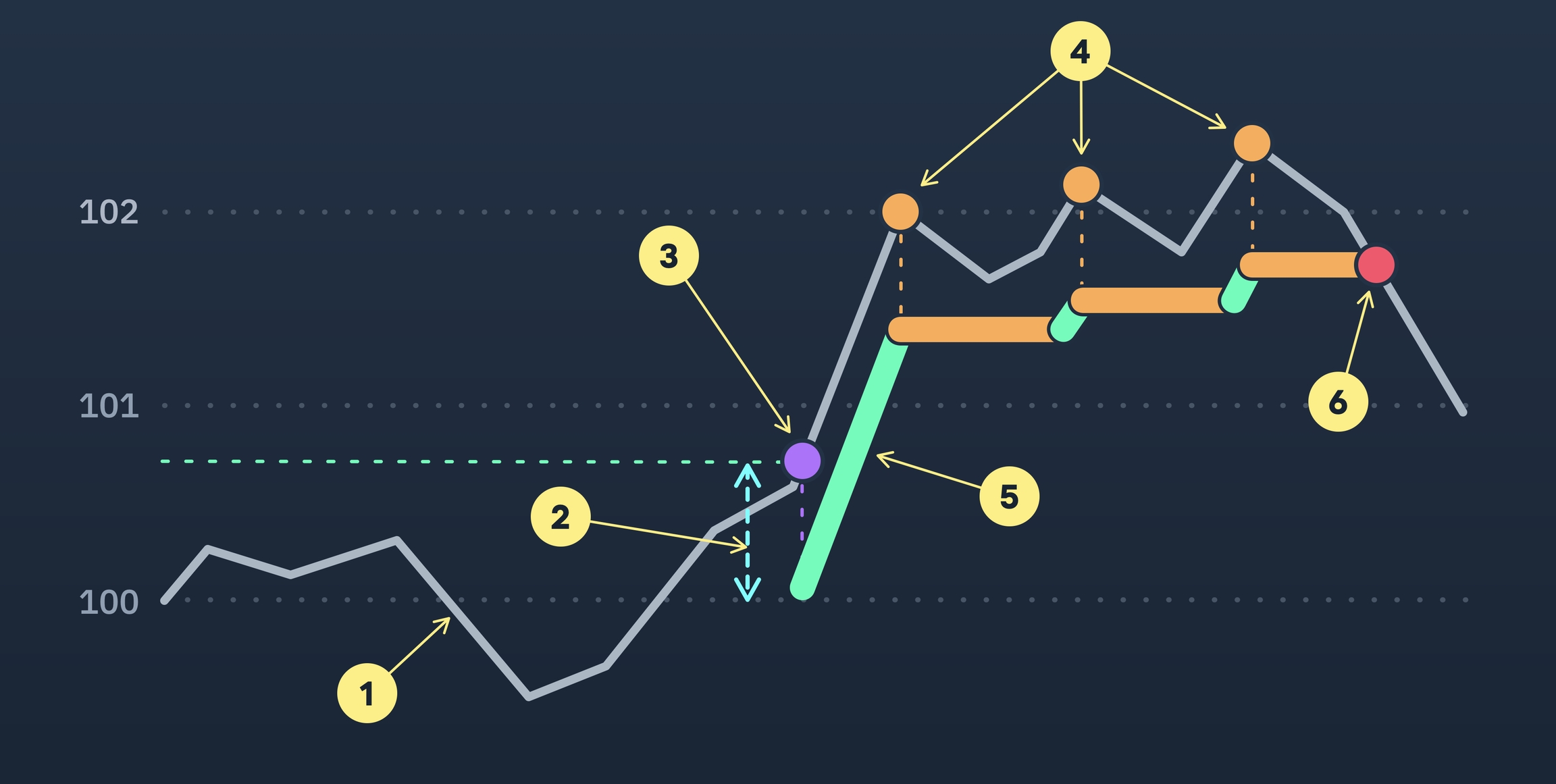

Currency price-based trailing

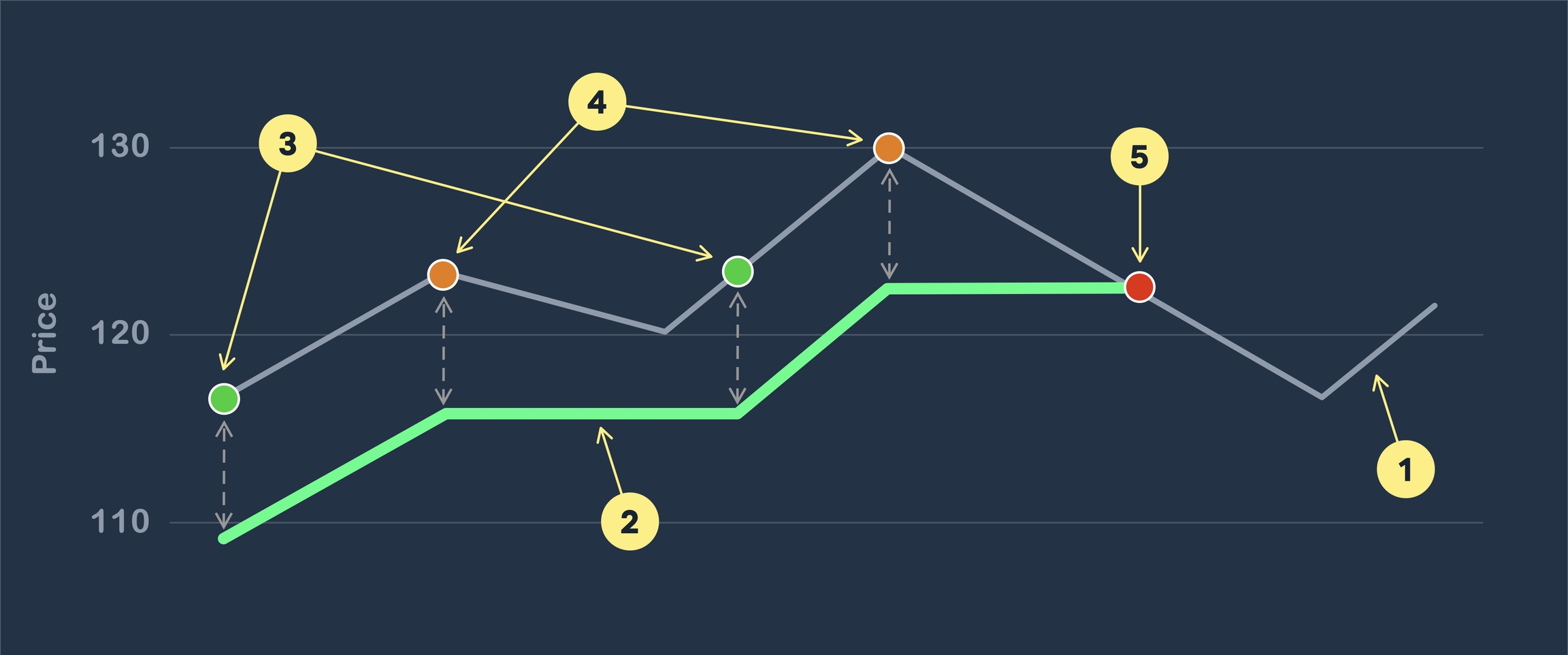

Trailing stop loss principles:

Currency pair price movement

Trailing stop repositioning

Trailing Trigger Points

Dynamic stop points

Stop loss activation

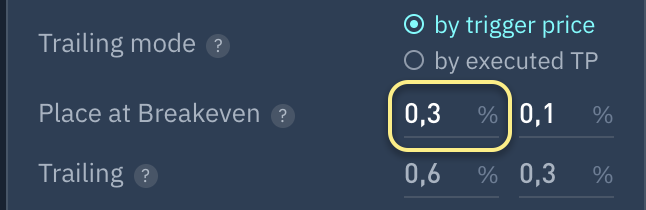

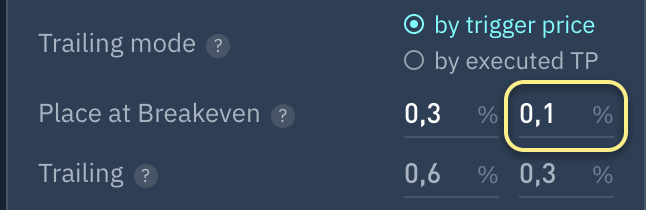

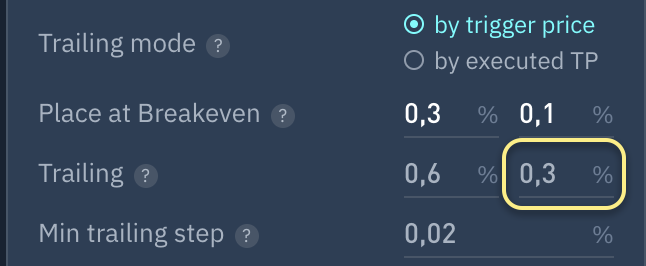

1. Place at Breakeven, %

Stop Loss is automatically set to breakeven price when specified profit percentage is reached.

Disabled if field is blank.

2. Breakeven offset, %

The Stop Loss order is placed at a certain offset percentage from the breakeven price upon trigger activation in step 1. This feature can increase potential profit when the position is closed by Stop Loss.

If this field is blank, SLX will place an SL order at break-even price when the trigger in step 1 is activated.

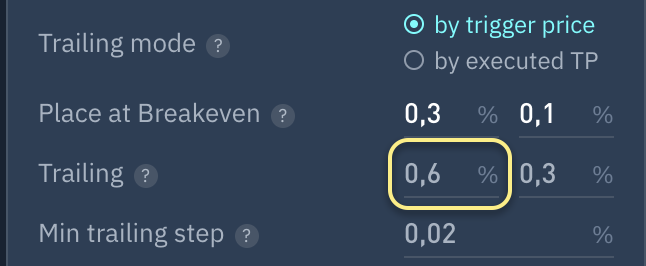

3. Trailing activation (tracking)

Specify profit percentage for Trailing Stop activation. Disables SL module if active.

Disabled if field is blank.

For example, if 0.5 is specified for a long position with a price of 100, Trailing will be activated when the price is above 100.5.

4. Price offset trigger (callback rate)

Percentage gap between SL price and current currency pair price.

Currency pair price movement

Offset

Trailing stop activation

Dynamic stop points

Price movement controlled by SLX module for Stop orders

Position closing

Stop Loss follows the trend for Long positions when moving up and remains fixed when moving down.

For Short positions, the Stop Loss follows the trend when moving down and remains fixed when moving up.

5. Minimum repositioning step

Minimum percentage difference between current and new price required for Stop Loss movement when trigger is activated.

Currency pair price movement

Previous Stop Loss price

New Stop Loss price

Stop Loss relocation event

Minimum relocation step - distance equal to or greater than the minimum StopLoss step

SL variations occur discreetly, no more than 0.02% of current price. For example, if a variation occurred at a price of 100, the next variation will occur when the price reaches 100.02.

6. Min. position volume

If position volume is below the specified value, Trailing will not be activated and SL will not be adjusted to Breakeven.

Example

In this example, SLX module will set the stop loss to breakeven or start trailing only if the position size is over 100.

Market buy for 50 USDT volume.

PnL

Volume of the position

Trailing

0%

50 USDT

-

2. Currency pair price increased, and trailing failed to start as position size was lower than the specified value.

PnL

Volume of the position

Trailing

1%

50 USDT

-

3. Position averaged out, but trailing stop still inactive as profit has not reached the set trigger.

PnL

Volume of the position

Trailing

0.4%

200 USDT

-

Currency pair price has increased and trailing has been activated.

PnL

Volume of the position

Trailing

0.7%

200 USDT

✅

7. Price Trigger

Current price - follows currency pair current price.

Order book - follows best bid/ask price in the order book. Protects against false price movements (squeezes).

Candle Timeframe - SL is moved if candle's closing price deviates a certain percentage from the specified timeframe.

8. Order Type

Virtual Floating - Auto-swap enabled limit order for more profitable exits in high-spread currencies.

Virtual Market - Virtual order that triggers a real order to execute at market price based on other participants' bids.

Stop Market - is a type of exchange order that initiates a market order once the stop price is triggered*.

*Be aware of market liquidity and volatility when using market orders, as they can execute at a price that is higher/lower than the most recent visible.

9. Order trigger

Additional options for virtual orders.

Trigger for virtual order to close position with a real order.

Current Price If virtual order's trigger price crosses the currency pair price, a real order is created (step 5).

Order book Checks the sell limit price for a Long position and the buy limit price for a Short position. Protects against false price movements (squeezes).

1m candle, 3m candle, etc. First value is candle's timeframe.

Long position will be closed by the Stop Loss if the trigger candle closes at or below the SL level.

Short position will be closed by the Stop Loss if the trigger candle closes at or above the SL level.

10. Action on #CA

When placing a SL at breakeven level, averaging orders will be canceled or remain unchanged.

Parameter

Description

Off(default)

Averaging orders will remain active and not be canceled when the SLX module is enabled.

Cancel #CA

All averaging orders will be cancelled when the SLX module is enabled.

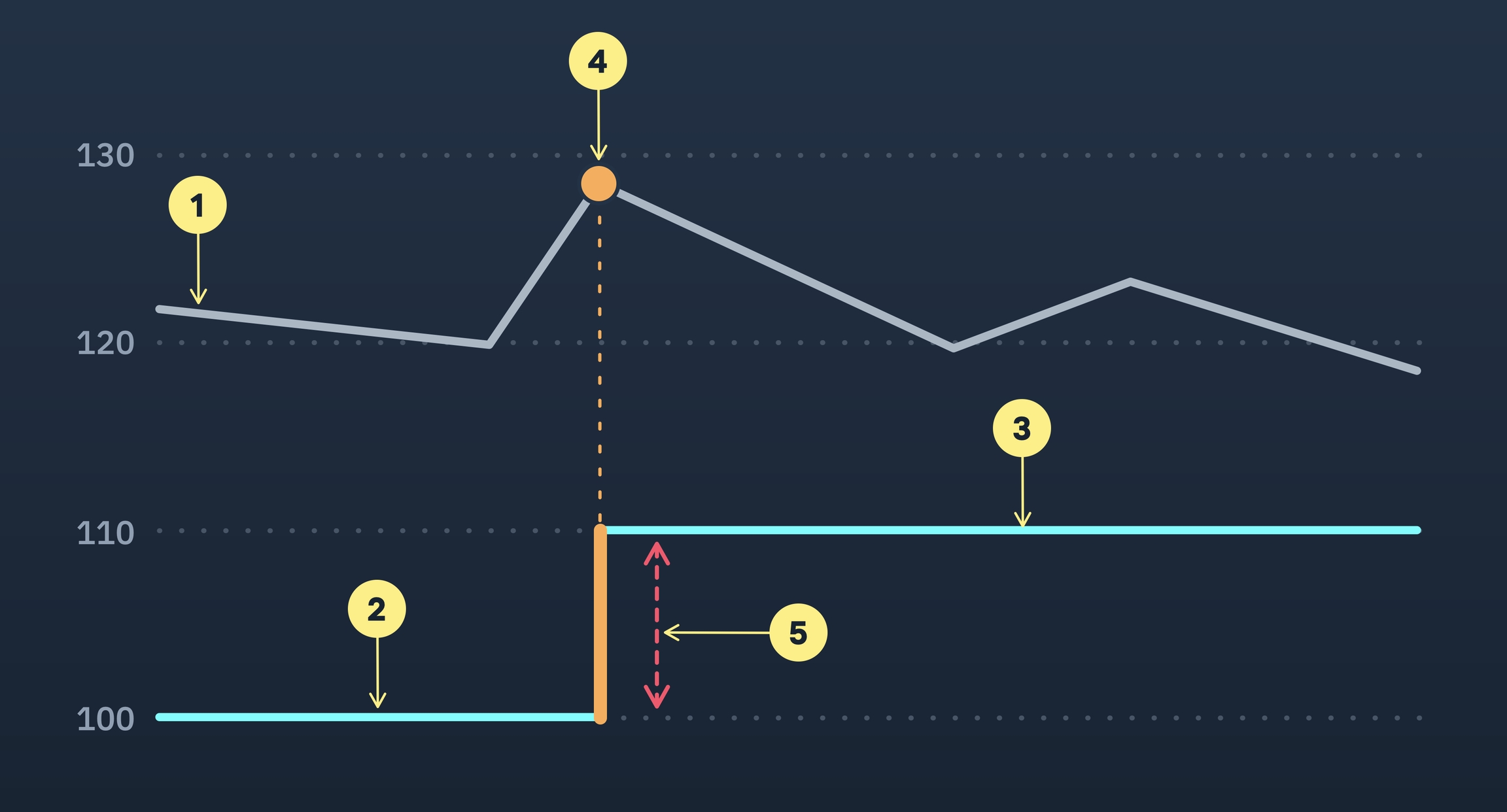

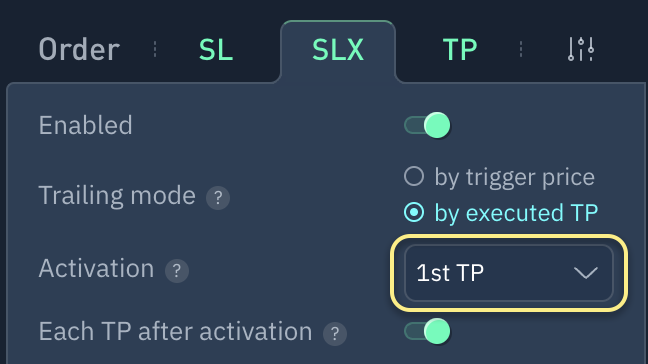

Trailing based on executed Take Profits

The module creates or repositions a Stop Loss when a Take Profit order is executed on a position.

1. Activation at BreakEven

When № Take Profit is executed, it moves to Break-even Point and continues to follow the executed Take Profit (if specified in set point #2).

For example, If you activate Break-Even (BE) at 1 TP execution, the module will cancel current Stop Loss (SL) after the first TP is executed and set a new SL at the original break-even price.

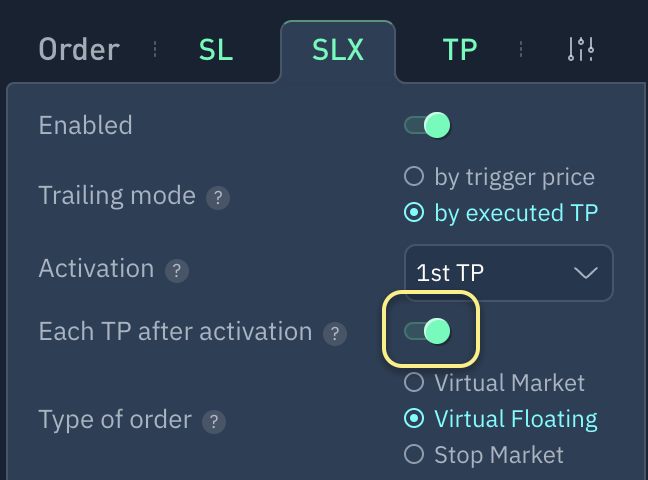

2. Each TP

Once activated, each executed Take Profit will move Stop Loss closer to the trend based on table´s algorithm. If deactivated, Stop Loss will be set at break-even position´s price and will not be adjusted.

Assuming activation occurs from the second TP, the module will perform the same actions for any other TP that triggers it.

Event

Action

Execution TP #2

SLX module cancels all existing SLs and sets a new SL at break-even price with the specified order type.

Execution TP #3

Cancels current SL, and set new SL at executed TP #1 price.

Execution TP #4

Cancels current SL, and set new SL at executed TP #2 price.

etc.

etc.

3. Order type

Virtual Floating - Auto-swap enabled limit order for more profitable exits in high-spread currencies.

Virtual Market - Virtual order that triggers a real order to execute at market price based on other participants bids.

Stop Market - is a type of exchange order that initiates a market order once the stop price is triggered*.

*Be aware of market liquidity and volatility when using market orders, as they can execute at a price that is higher/lower than the most recent visible.

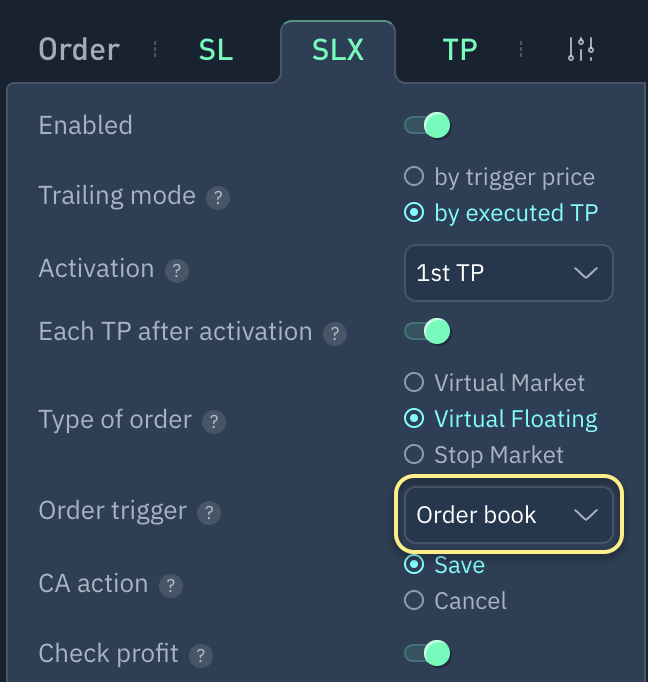

4. Order trigger

Additional options for virtual orders.

Trigger for virtual order to close position with a real order.

Current Price If virtual order's trigger price crosses the currency pair price, a real order is created (step 5).

Order book Checks the sell limit price for a Long position and the buy limit price for a Short position. Protects against false price movements (squeezes).

1m candle, 3m candle, etc. First value is candle's timeframe.

Long position will be closed by the Stop Loss if the trigger candle closes at or below the SL level. Short position will be closed by the Stop Loss if the trigger candle closes at or above the SL level.

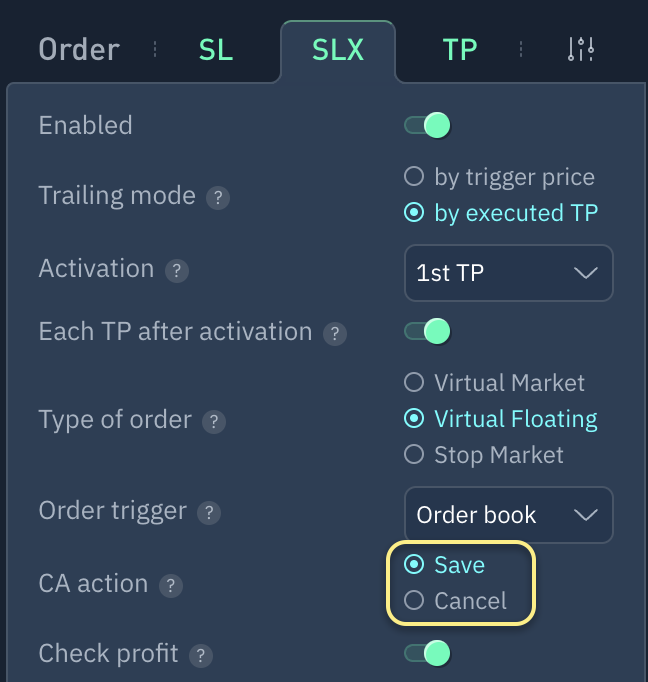

5. Action on #CA

When placing a SL at breakeven level, averaging orders will be canceled or remain unchanged.

Parameter

Description

Off(default)

Averaging orders will remain active and NOT be canceled when the SLX module is enabled.

Cancel #CA

All averaging orders will be cancelled when the SLX module is enabled.

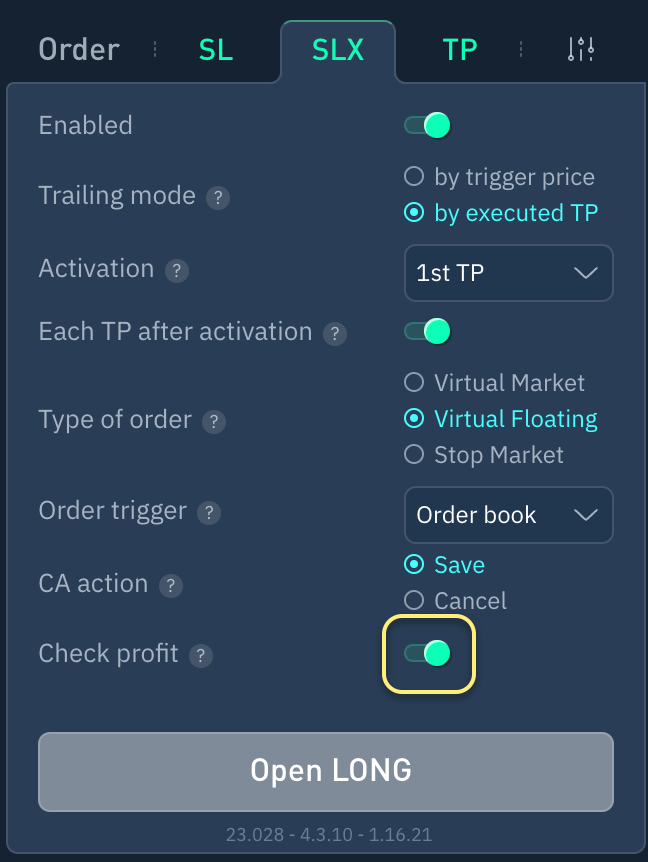

6. Check profit?

If enabled, SLX module will move the SL order only when there are profits in the position. If disabled, SLX module will move SL orders regardless of profit or loss.

Additionally

SLX activation is performed relative to the breakeven level for the position, but without funding. In case of negative funding for a position, closing a position through the SLX module may result in a loss. In the case of a long stay in a position, the influence of deduction/accrual for funding on the middle line is controlled by the trader independently.

When trading inside a position, please note that trailing is based on the average entry price, not position price.

Do you have any questions? We can help you in our Telegram chat.

Last updated